With the meteoric rise of cryptocurrencies in recent years, the allure of mining these digital assets has captivated the attention of tech enthusiasts, investors, and entrepreneurs alike. Cryptocurrency mining, the process of validating transactions and securing blockchain networks, has emerged as a potentially lucrative endeavor. However, as the industry continues to evolve, it begs the question: Is cryptocurrency mining still profitable?

Factors Affecting Mining Profitability

Cryptocurrency mining profitability is influenced by various factors that miners need to consider before diving into the world of digital asset extraction. Understanding these factors is crucial for making informed decisions and optimizing returns. Let’s explore the key factors that impact mining profitability.

Initial investment costs:

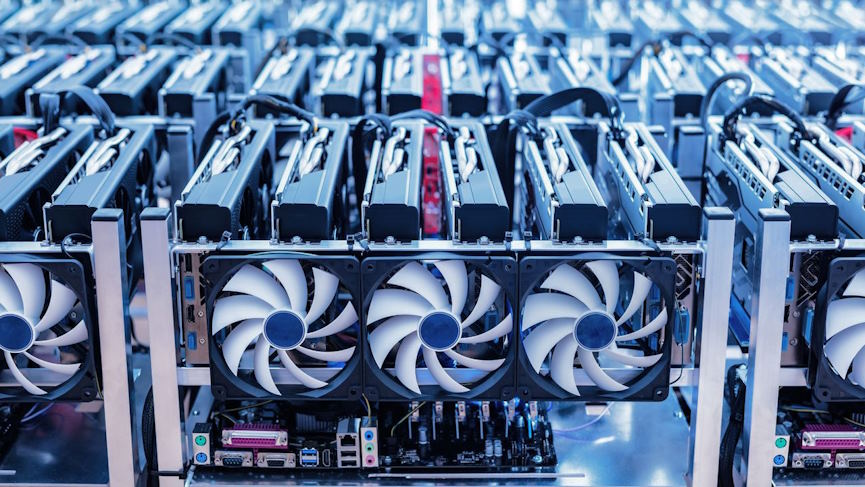

To embark on a mining venture, miners need to make significant initial investments. These costs primarily include hardware and infrastructure expenses. Hardware options range from specialized mining devices like ASICs (Application-Specific Integrated Circuits) to more general-purpose options like GPUs (Graphics Processing Units) and CPUs (Central Processing Units). The choice of hardware depends on the specific cryptocurrency being mined and its mining algorithm. Additionally, miners must account for infrastructure costs such as electricity and cooling systems to ensure efficient operation.

Electricity costs and energy efficiency:

Electricity costs play a vital role in mining profitability, as mining operations consume substantial amounts of power. The cost of electricity varies significantly across regions, impacting the overall expenses for miners. Comparing mining costs in different regions helps miners identify locations with favorable electricity rates. Furthermore, energy efficiency becomes crucial to reduce electricity expenses. Miners often seek energy-efficient hardware and explore renewable energy sources to minimize costs and enhance profitability.

Network difficulty and hash rate:

Mining difficulty and hash rate are essential factors that directly influence mining rewards. Mining difficulty refers to the level of complexity involved in solving the cryptographic puzzles required for mining new blocks. As more miners join the network, the difficulty increases, which affects the time and computational power required to mine a block. Miners must stay updated with mining difficulty adjustments to anticipate changes in rewards and adjust their strategies accordingly.

Block rewards and transaction fees:

Block rewards, the incentive for miners, are crucial for profitability. They consist of newly minted cryptocurrency units awarded to the successful miner who adds a new block to the blockchain. However, block rewards often undergo changes over time, decreasing as the cryptocurrency matures or as specific milestones are reached. Consequently, miners must consider the importance of transaction fees. Transaction fees collected from users can supplement block rewards, impacting the overall profitability of mining operations.

Risks and Challenges

While cryptocurrency mining holds the promise of significant profits, it is not without its fair share of risks and challenges. Miners must navigate a landscape characterized by volatility, market risks, regulatory considerations, and environmental concerns. Understanding and managing these risks is vital for long-term success in the mining industry.

Volatility and market risks:

Cryptocurrencies are notorious for their price volatility, which directly affects mining profitability. Rapid price fluctuations can lead to substantial shifts in the value of mined coins, impacting revenue generation. Miners must monitor market trends closely and be prepared for sudden price drops or spikes. Additionally, market sentiment plays a crucial role in mining profitability. Investor sentiment, news events, and global economic factors can influence the demand and value of cryptocurrencies, directly impacting the rewards obtained through mining.

Regulatory considerations:

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Changes in regulations can have a significant impact on mining operations. Governments and financial institutions around the world are developing policies to address concerns such as money laundering, tax evasion, and consumer protection. Miners must stay updated on the legal requirements in their jurisdictions and ensure compliance with licensing, reporting, and taxation obligations. Failure to comply with regulations can result in penalties or even the shutdown of mining operations.

In addition to regulatory considerations, environmental concerns and sustainability are increasingly important in the mining industry. The energy-intensive nature of mining has raised concerns about its carbon footprint and environmental impact. Miners are under pressure to adopt energy-efficient practices and explore renewable energy sources to mitigate the environmental effects of their operations. Adhering to sustainable mining practices not only helps protect the planet but also enhances the industry’s reputation and longevity.